High value pre existing individual accounts are accounts with an aggregate balance or value that exceeds an amount equivalent to 7 8 million as at the date that the pre existing accounts first need to be reviewed or at any 31 december following the initial review date.

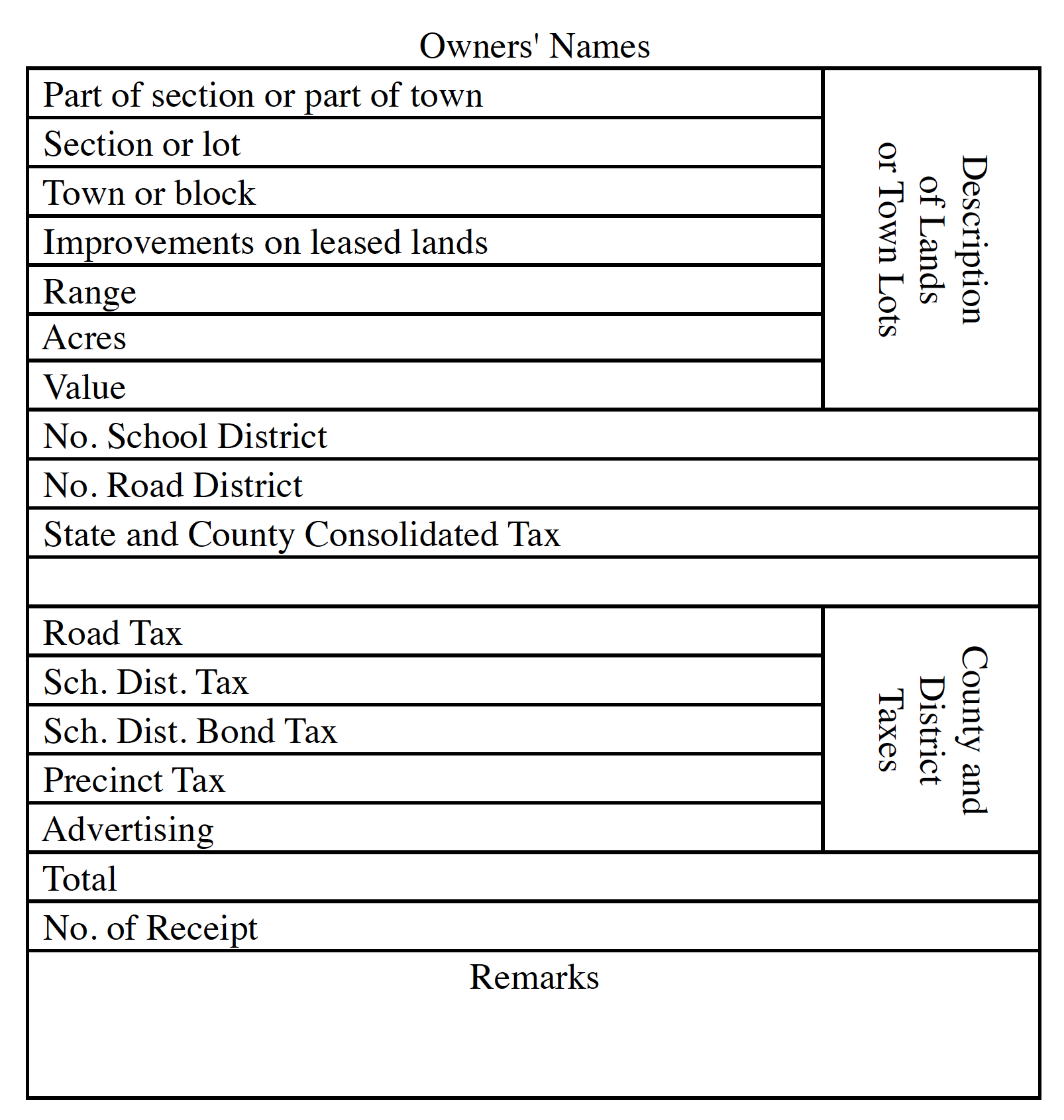

Tax value of pre existing carpet.

If you filed a statement with your 2014 tax return indicating that your qualifying trade or business is not applying the simplified procedure.

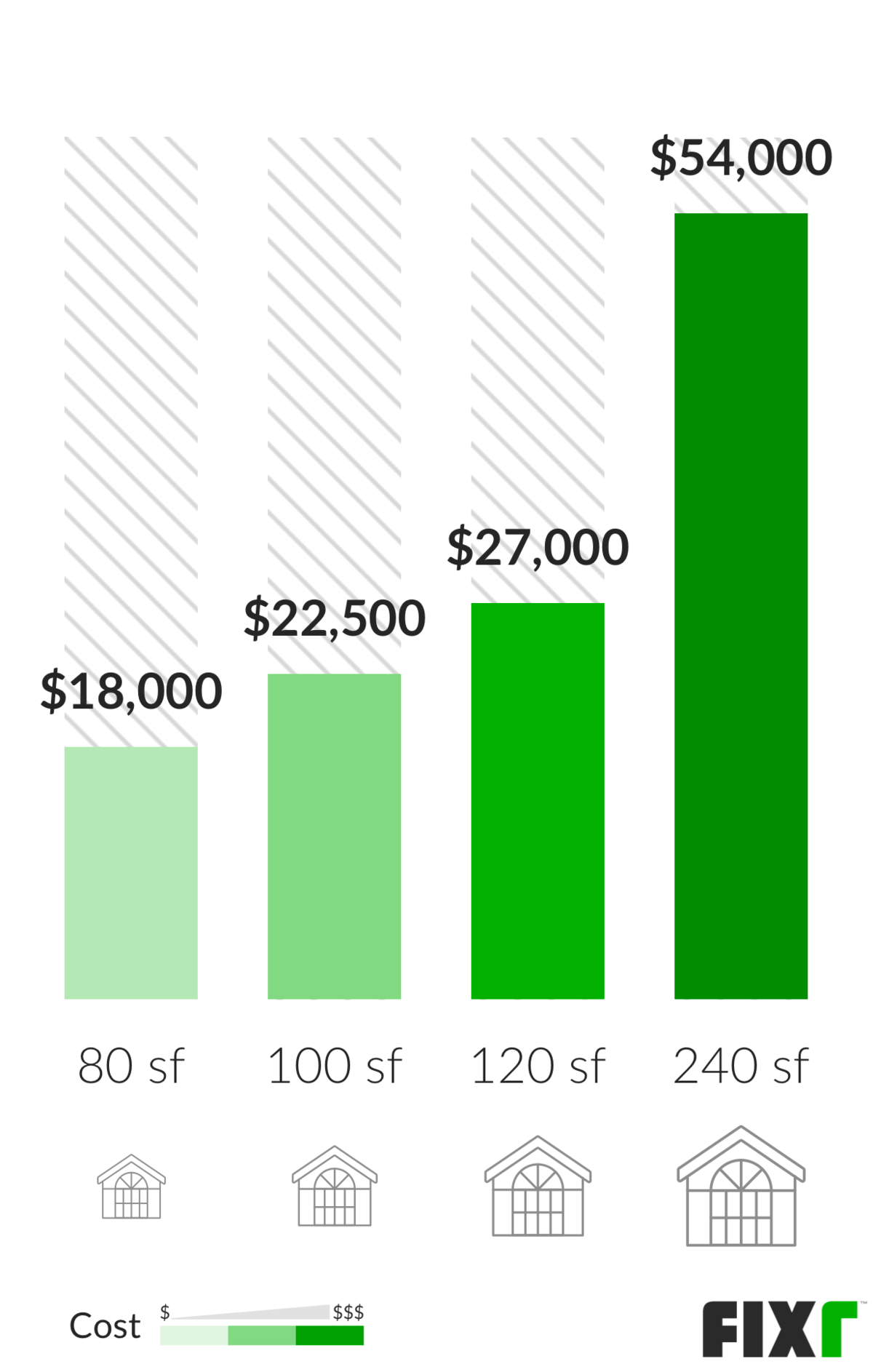

Carpet replacement is considered an improvement and is depreciated over a 5 year period 9 years under the alternative system.

The final tangibles regulations merely incorporate pre existing precedents on the definition and treatment of materials and supplies and add some safe harbors to provide you with additional certainty.

Whether you re fixing a hole in the wall or a unclogging a shower drain you can deduct the cost of these minor repairs from the current year s tax liability.

When the grazing fee was first instituted on the forest reserves it was often referred to as a property tax permits quantified a certain number of aums animal unit months or the amount of feed required for one cow for one month as descriptive of a grazer s pre existing rights of use.

You can continue to depreciate a rental property over time until you sell the property or you ve depreciated your entire cost basis.

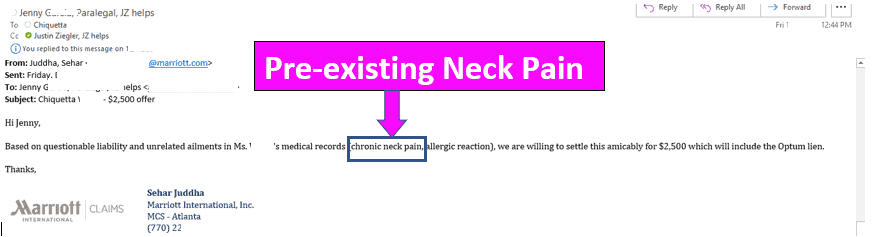

Policyholder is entitled to a 10 per cent discount on premium on producing certain medical reports to the satisfaction of the insurer pre existing diseases are covered from the first day of policy inception with a co payment clause.

For more information irs pub.

Repairs are usually one off fixes that help keep the property in good working condition and habitable although the price is irrelevant most of my qualifying repairs tend to be under 500 in cost.

Here s how to know what home improvements can pay off at tax time.

A tax assessment is another way to separate the value of land.

527 residential rental property.

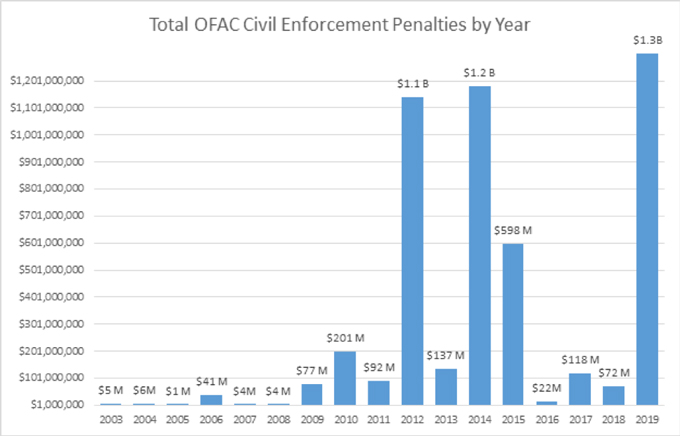

Need for manual paper searches to high value accounts with balances over 1 000 000.

The tax benefit doesn t come into play for everyone.

Can i write this off as a maintenance expense.

I have a tax question.

The large majority of homesellers will never have to pay taxes on the profits they make on their homes because of a widely available exemption on the first 250 000 of profit for single filers 500 000 for joint filers.

Furthermore the draft regulations include relief provisions whereby pre existing entity accounts with account balances of 250 000 or less are exempt from review until the account balance exceeds 1 000 000 at the end of any calendar year.