Tankless water heater tax credits are often part of an initiative to improve a nation s overall carbon footprint or lower average energy use through the tax code.

Tankless water heater tax credit 2015.

That means if you installed a qualifying tankless water heater last year you could get the credit on the return you file in 2020 for 2019.

The credit amount for gas oil propane water heaters including tankless units is 300.

Product category product type tax credit specification tax credit water heater gas oil propane energy factor 0 82 or a thermal efficiency of at least 90 up to 300 00.

Tax credits for residential energy efficiency have now been extended retroactively through december 31 2020.

The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020.

Federal income tax credits and other incentives for energy efficiency.

Tankless federal tax credit federal income tax credits and other incentives for energy efficiency under the bipartisan budget act of 2018 which was signed in february 2018 a number of tax credits for residential energy efficiency that had expired at the end of 2016 were renewed.

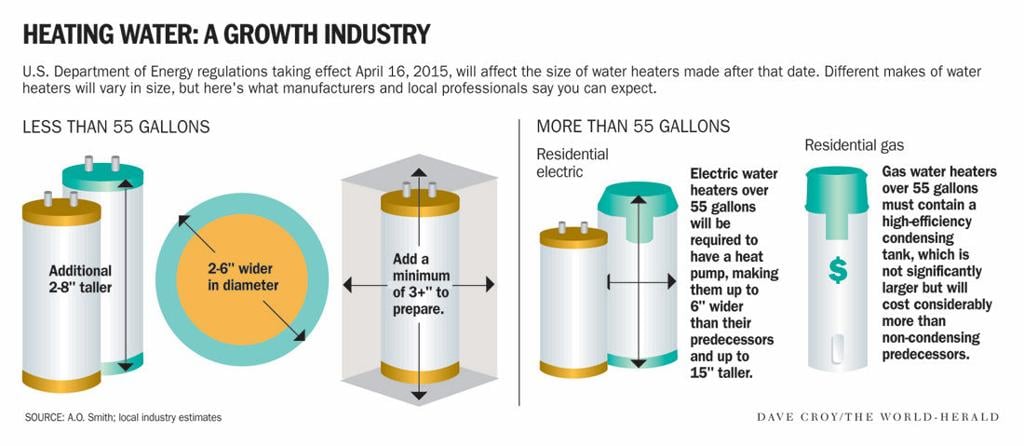

Are you prepared to replace your water heater.

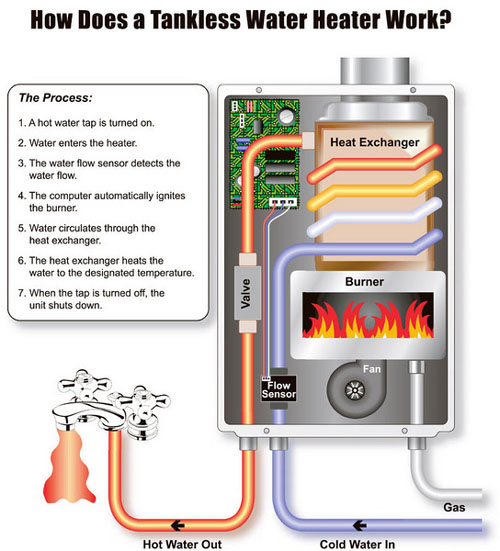

These types of hot water heaters have been around for a while and many models offer a less energy consuming option for keeping a home supplied with hot water.

Tankless gas water heaters qualified navien condensing tankless gas water heater models.

A tankless water heater tax credit is a government s tax credit to citizens who take advantage of switching to a more energy efficient tankless hot water heater.

State of oregon income tax credit the state of oregon is offering a tax credit for the installation of gas tankless water heaters.

Aside from saving costs on your utility bills by going tankless you can gain a credit on your income taxes for purchasing an energy efficient tankless water heater as long as the water heater was installed by december 31 of the previous year.

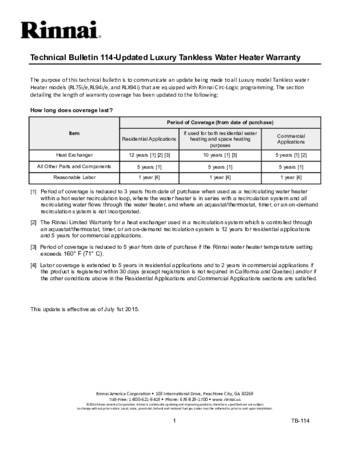

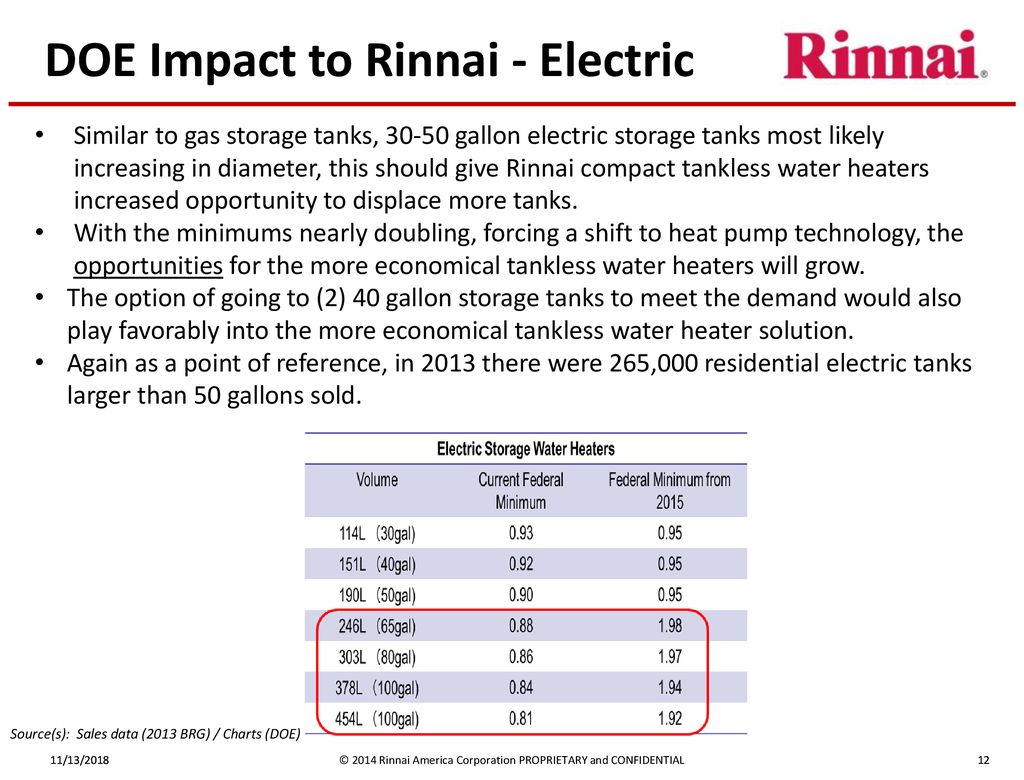

For a tankless unit to qualify it must have a uniform energy factor uef of at least 0 82 all rinnai condensing tankless water heaters and the v94xi non condensing tankless water heater qualify.

However if you must go for an electric version then consider the pump water heaters because the tax credit is applicable to its purchase.

225 state tax credit for ef of 82 849 245 state tax credit for ef of 85 or more.

Of course any qualifying tankless water heater installed this year would also qualify on taxes due in april 2021.

In the past too deductions were offered to encourage the use of energy efficient home appliances such as tankless water heaters.

The tax credit is based on the amount of energy saved above standard models.